Pool Equipment Depreciation Life . calculating equipment depreciation life involves three primary factors that are explained below: taxpayers can recalculate the effective life of a depreciating asset if the effective life used is no longer relevant. To make sure you comply, please refer to your specific. Amusement parks and centres operation. group depreciation combines similar fixed assets into a pool with a common cost base for calculating depreciation on financial. you can deduct depreciation on the part of the house used for rental purposes as well as on the furniture and equipment you use for rental purposes. 44 rows filtration assets (including pumps) 8 years. depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. the irs has very specific guidelines for depreciation.

from www.slideserve.com

To make sure you comply, please refer to your specific. group depreciation combines similar fixed assets into a pool with a common cost base for calculating depreciation on financial. calculating equipment depreciation life involves three primary factors that are explained below: you can deduct depreciation on the part of the house used for rental purposes as well as on the furniture and equipment you use for rental purposes. depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. the irs has very specific guidelines for depreciation. 44 rows filtration assets (including pumps) 8 years. Amusement parks and centres operation. taxpayers can recalculate the effective life of a depreciating asset if the effective life used is no longer relevant.

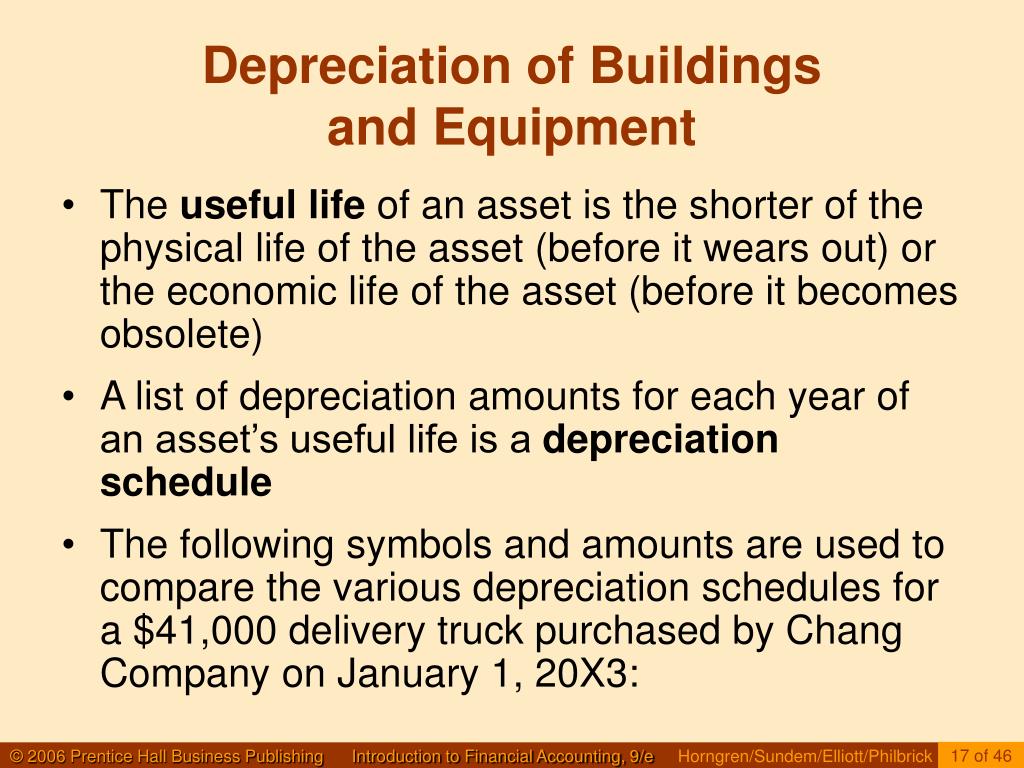

PPT LongLived Assets and Depreciation PowerPoint Presentation, free

Pool Equipment Depreciation Life the irs has very specific guidelines for depreciation. you can deduct depreciation on the part of the house used for rental purposes as well as on the furniture and equipment you use for rental purposes. group depreciation combines similar fixed assets into a pool with a common cost base for calculating depreciation on financial. the irs has very specific guidelines for depreciation. To make sure you comply, please refer to your specific. taxpayers can recalculate the effective life of a depreciating asset if the effective life used is no longer relevant. depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. 44 rows filtration assets (including pumps) 8 years. Amusement parks and centres operation. calculating equipment depreciation life involves three primary factors that are explained below:

From mromavolley.com

Flooring Depreciation Life Irs Floor Roma Pool Equipment Depreciation Life you can deduct depreciation on the part of the house used for rental purposes as well as on the furniture and equipment you use for rental purposes. Amusement parks and centres operation. depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. the irs has very specific guidelines for. Pool Equipment Depreciation Life.

From haipernews.com

How To Calculate Depreciation Example Haiper Pool Equipment Depreciation Life calculating equipment depreciation life involves three primary factors that are explained below: Amusement parks and centres operation. 44 rows filtration assets (including pumps) 8 years. group depreciation combines similar fixed assets into a pool with a common cost base for calculating depreciation on financial. depreciable amount is the cost of an asset, or other amount substituted. Pool Equipment Depreciation Life.

From elchoroukhost.net

Us Gaap Depreciation Useful Life Table Elcho Table Pool Equipment Depreciation Life the irs has very specific guidelines for depreciation. group depreciation combines similar fixed assets into a pool with a common cost base for calculating depreciation on financial. Amusement parks and centres operation. To make sure you comply, please refer to your specific. you can deduct depreciation on the part of the house used for rental purposes as. Pool Equipment Depreciation Life.

From www.coursehero.com

[Solved] Please help with the accumulated depreciation and depreciation Pool Equipment Depreciation Life calculating equipment depreciation life involves three primary factors that are explained below: you can deduct depreciation on the part of the house used for rental purposes as well as on the furniture and equipment you use for rental purposes. To make sure you comply, please refer to your specific. taxpayers can recalculate the effective life of a. Pool Equipment Depreciation Life.

From ams.aha.org

2023 Estimated Useful Lives of Depreciable Hospital Assets, PDF, 610 Users Pool Equipment Depreciation Life 44 rows filtration assets (including pumps) 8 years. calculating equipment depreciation life involves three primary factors that are explained below: you can deduct depreciation on the part of the house used for rental purposes as well as on the furniture and equipment you use for rental purposes. To make sure you comply, please refer to your specific.. Pool Equipment Depreciation Life.

From www.chegg.com

Solved The depreciation schedule for certain equipment has Pool Equipment Depreciation Life Amusement parks and centres operation. 44 rows filtration assets (including pumps) 8 years. you can deduct depreciation on the part of the house used for rental purposes as well as on the furniture and equipment you use for rental purposes. depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual. Pool Equipment Depreciation Life.

From naythandilek.blogspot.com

Calculate depreciation rate from effective life NaythanDilek Pool Equipment Depreciation Life 44 rows filtration assets (including pumps) 8 years. taxpayers can recalculate the effective life of a depreciating asset if the effective life used is no longer relevant. calculating equipment depreciation life involves three primary factors that are explained below: group depreciation combines similar fixed assets into a pool with a common cost base for calculating depreciation. Pool Equipment Depreciation Life.

From www.wikihow.com

4 Ways to Depreciate Equipment wikiHow Pool Equipment Depreciation Life depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Amusement parks and centres operation. you can deduct depreciation on the part of the house used for rental purposes as well as on the furniture and equipment you use for rental purposes. calculating equipment depreciation life involves three primary. Pool Equipment Depreciation Life.

From haipernews.com

How To Calculate Notional Depreciation Haiper Pool Equipment Depreciation Life depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. you can deduct depreciation on the part of the house used for rental purposes as well as on the furniture and equipment you use for rental purposes. group depreciation combines similar fixed assets into a pool with a common. Pool Equipment Depreciation Life.

From www.bmtqs.com.au

Swimming Pool Items Which Make A Splash BMT Insider Pool Equipment Depreciation Life taxpayers can recalculate the effective life of a depreciating asset if the effective life used is no longer relevant. To make sure you comply, please refer to your specific. 44 rows filtration assets (including pumps) 8 years. calculating equipment depreciation life involves three primary factors that are explained below: Amusement parks and centres operation. you can. Pool Equipment Depreciation Life.

From www.wallstreetprep.com

What is Depreciation? Expense Formula + Calculator Pool Equipment Depreciation Life Amusement parks and centres operation. the irs has very specific guidelines for depreciation. you can deduct depreciation on the part of the house used for rental purposes as well as on the furniture and equipment you use for rental purposes. calculating equipment depreciation life involves three primary factors that are explained below: 44 rows filtration assets. Pool Equipment Depreciation Life.

From printablelibfester.z13.web.core.windows.net

Depreciation Table Excel Template Pool Equipment Depreciation Life depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. 44 rows filtration assets (including pumps) 8 years. Amusement parks and centres operation. the irs has very specific guidelines for depreciation. calculating equipment depreciation life involves three primary factors that are explained below: you can deduct depreciation. Pool Equipment Depreciation Life.

From www.bmtqs.com.au

Software Depreciation Maximises Cash Flow BMT Insider Pool Equipment Depreciation Life Amusement parks and centres operation. To make sure you comply, please refer to your specific. calculating equipment depreciation life involves three primary factors that are explained below: the irs has very specific guidelines for depreciation. taxpayers can recalculate the effective life of a depreciating asset if the effective life used is no longer relevant. you can. Pool Equipment Depreciation Life.

From haipernews.com

How To Calculate Depreciation Cost Of Laptop Haiper Pool Equipment Depreciation Life group depreciation combines similar fixed assets into a pool with a common cost base for calculating depreciation on financial. depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. 44 rows filtration assets (including pumps) 8 years. Amusement parks and centres operation. calculating equipment depreciation life involves three. Pool Equipment Depreciation Life.

From elchoroukhost.net

Us Gaap Depreciation Useful Life Table Elcho Table Pool Equipment Depreciation Life taxpayers can recalculate the effective life of a depreciating asset if the effective life used is no longer relevant. To make sure you comply, please refer to your specific. the irs has very specific guidelines for depreciation. calculating equipment depreciation life involves three primary factors that are explained below: you can deduct depreciation on the part. Pool Equipment Depreciation Life.

From mromavolley.com

Flooring Depreciation Life Irs Floor Roma Pool Equipment Depreciation Life 44 rows filtration assets (including pumps) 8 years. To make sure you comply, please refer to your specific. group depreciation combines similar fixed assets into a pool with a common cost base for calculating depreciation on financial. the irs has very specific guidelines for depreciation. Amusement parks and centres operation. you can deduct depreciation on the. Pool Equipment Depreciation Life.

From forestrypedia.com

Depreciation Pool Equipment Depreciation Life To make sure you comply, please refer to your specific. the irs has very specific guidelines for depreciation. taxpayers can recalculate the effective life of a depreciating asset if the effective life used is no longer relevant. 44 rows filtration assets (including pumps) 8 years. depreciable amount is the cost of an asset, or other amount. Pool Equipment Depreciation Life.

From mromavolley.com

Flooring Depreciation Life Irs Floor Roma Pool Equipment Depreciation Life you can deduct depreciation on the part of the house used for rental purposes as well as on the furniture and equipment you use for rental purposes. calculating equipment depreciation life involves three primary factors that are explained below: 44 rows filtration assets (including pumps) 8 years. the irs has very specific guidelines for depreciation. Web. Pool Equipment Depreciation Life.